By Tim Courtney, Chief Investment Officer

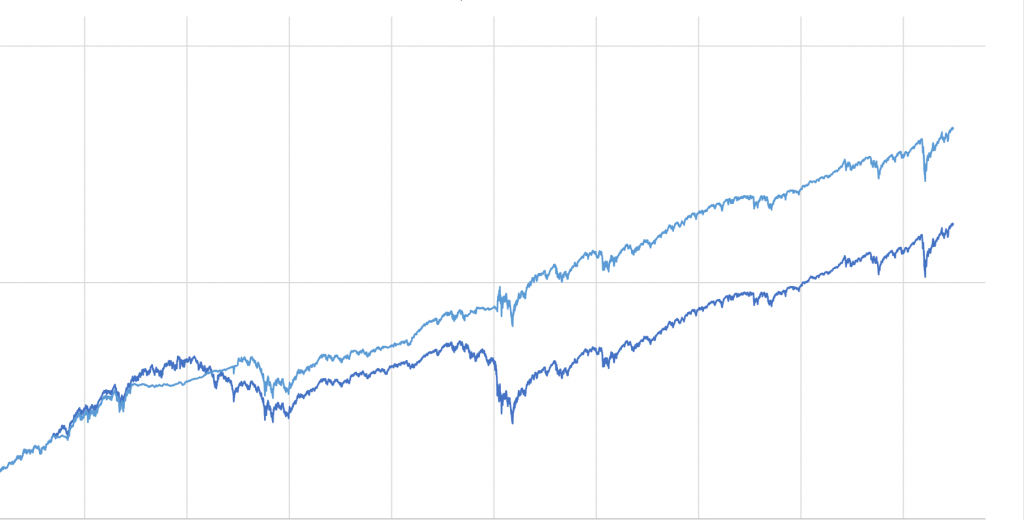

We recently wrapped up the 19th best eight-month period for the market out of all 1,132 eight-month periods going back to 1926. From April through November, the S&P 500 Index was up 41.8%.1 Additionally, the markets just had their strongest November in 87 years, up just under 11%.1

Many have watched this huge run and wondered why the markets have behaved like this in the middle of a pandemic while our economy remains smaller than it was at the beginning of the year. Understandably, there has been some concern that the gains will soon come to an end.

However, several gauges show that investors remain bullish. The CNN Fear & Greed Index, which measures investor sentiment, has entered “Extreme Greed” territory, indicating that investors are feeling very optimistic.2 The CBOE Volatility Index (VIX) is signaling that expected stock market volatility is easing3 and gold prices, another common measure of fear, have also been falling suggesting that investors are not flocking to safe-haven investments.4

But while these measures are indicating market fears are lessening, one important measure – the bond market – seems to be forecasting weakness. Bond market prices are at high levels, as they have been since the start of the recession. This means interest rates are very low (a main driver of record mortgage refinancing this year5). The 10-year treasury bond interest rate is 0.92%, stubbornly holding below 1%.6

When entering a recovery, you would normally expect to see interest rates rise as demand for capital rises and bond investors begin to factor in higher levels of growth. This is not happening, though. Too many bond holders are content to receive 0.92% in interest for a decade before taxes and inflation erode their real return to zero or worse. They shouldn’t be willing to do this unless they thought growth and inflation would slow and economic conditions would weaken.

It could be that the bond market is forecasting weakness ahead, and there certainly has been enough economic damage wrought this year to justify that forecast. But there may be another explanation for the way the bond market is behaving. It may be that a combination of Fed action and investor speculation is keeping interest rates abnormally low. The Fed has noted their intentions to potentially buy more bonds7 to keep interest rates low. This has caused some investors to speculate that the Fed will keep a lid on interest rates (and maybe even go lower) until we are well down the road to recovery.

This means that the bond market may not be functioning as a valid price signal today. It’s hard to distinguish whether it’s truly warning us of weakness or if it is now reflecting investor beliefs that the Fed will not allow rates to move higher for now.

That’s an important question because interest rates help provide a foundation for the valuation of many other assets. When interest rates approach zero, prices of other assets lose their natural tether and may start to behave like they exist in a zero-gravity environment (see recent IPOs’ stratospheric rise8).

While we shouldn’t be surprised if the stock market has a normal correction following a strong move higher, most signals point to a continued economic recovery with momentum into 2021. The bond market may be saying something different, and we will be monitoring this closely to guide our investment decisions moving forward.

Sources:

1. DFA Returns (data as of 11/30/20) – S&P 500 TR Index monthly

2. CNN Business (11/30/20) — Investors are getting greedy again

3. Yahoo! Finance (data as of 12/21/20) — CBOE Volatility Index

4. MarketWatch (11/30/20) — Gold ends at a 5-month low as vaccine news pulls prices down by nearly 6% in November

5. CNBC.com (12/16/20) – Refinance demand jumps 105% annually, as mortgage rates set 15th record low of 2020

6. MarketWatch (data as of 12/21/20) — U.S. 10 Year Treasury Note

7. USA Today (12/16/20) — Fed vows to continue bond-buying but opts against moves that would lower mortgage rates

8. Bloomberg (12/9/20) – Airbnb, DoorDash rallies stoke debate on pricing IPOs

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The CNN Fear and Greed Index is a measurement that attempts to determine if current market prices are being driven more by fear or greed. CNN looks at 7 indicators: Stock Price Momentum (The S&P 500 (SPX) versus its 125-day moving average), Stock Price Strength (The number of stocks hitting 52-week highs and lows on the New York Stock Exchange), Stock Price Breadth (The volume of shares trading in stocks on the rise versus those declining), Put and Call Options (The put/call ratio, which compares the trading volume of bullish call options relative to the trading volume of bearish put options), Junk Bond Demand (The spread between yields on investment grade bonds and junk bonds), and Market Volatility (The VIX, which measures volatility, and Safe Haven Demand (The difference in returns for stocks versus Treasuries). For each indicator, they look at how far they’ve veered from their average relative to how far they normally veer. They look at each on a scale from 0 – 100. The higher the reading, the greedier investors are being, and 50 is neutral. Then they put all the indicators together – equally weighted – for a final index reading.

Created by the Chicago Board Options Exchange (CBOE), the Volatility Index, or VIX, is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments.

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this informational piece. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information being provided herein. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971