By Alex Klingelhoeffer, CFA, CFP, Wealth Advisor

When it comes to market declines, one of the foremost jobs of an advisor is to keep a level head in times like this. At Exencial, a chief part of our value proposition is to ensure disciplined execution of a calculated investment strategy in both good and challenging markets. In short, our role is to execute on the things that we and our clients can control.

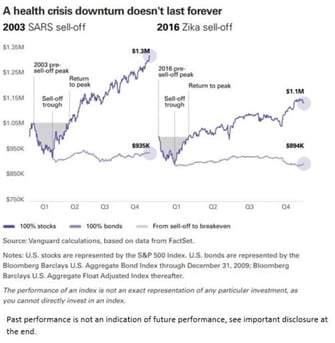

This is not the first time the market has approached a 20% decline within the current bull market. Nor is it the first time the market has pulled back due to an unforeseen health shock. In the past two decades, we have seen SARS, Avian Flu, Dengue Fever, Swine flu, Cholera, MERS, Ebola, and Zika all come, and in time, all pass through the market, and the economy.

After reaching a record high on February 19, the S&P 500 index has now retrenched 19% in the span of as many days. Fundamentally, it’s important to realize that downturns are not rare events. All markets, across all time periods, have entered periods of sustained decline. Even knowing this, it can be difficult for an investor approaching retirement to wake up today and see their portfolio so significantly affected by events outside their own control. The natural response is to do something, anything, to stem the pain of market declines. To combat these impulses, Exencial provides clients what we think are three powerful tools:

1) An investment strategy founded in academic research and tailored to your individual needs as an investor.

2) A war chest of fixed income to fund spending needs while waiting for equity prices to recover.

3) An experienced advisor to guide clients through the near-term uncertainty.

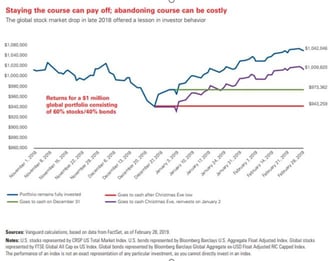

As an investor it is important to utilize these tools to help steward family assets through these times of uncertainty. We believe those who avoid selling assets at poor prices are more likely to reach their goals over the long term.

Many of our clients will remember the Christmas Eve low of 2018 where peak-to-trough, the broader US stock markets declined 19% on fears of a lingering trade war with China. Those who exited the market at that time did so to the detriment of their portfolios.

We don’t claim to know how bad this market downturn will be. However, using history as our guide, the ability of companies retain and grow their earnings over time is the driver of long term investing success. Our opinion is that short term headwinds will impact the revenues of the larger economy over the next 6-12 months, but that the long term fundamentals of the broader economy remain intact.

To sum, our advice during this time of repricing may ring familiar:

1) Re-evaluate your cash flow needs and discuss with your advisor if your needs have materially changed since you last met.

2) Remain diversified and resist the urge to sell assets at discount prices.

3) Wash your hands frequently.

Alex Klingelhoeffer, CFA, joined Exencial Wealth Advisors in 2019. Before joining Exencial, Alex worked for Charles Schwab in Austin, TX as a Sr. Financial consultant where he worked in the retirement planning, active trading, and portfolio analysis fields Alex graduated from the University of Missouri with dual degrees; a Bachelor of Arts in Economics and a Bachelor of Journalism degree. Alex is a CFA® charterholder and a member of the CFA Society of Oklahoma.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

The Bloomberg Barclays Aggregate Bond Index, is an index used by bond traders, mutual funds, and ETFs as a benchmark to measure their relative performance. The index includes government securities, mortgage-backed securities (MBS), asset-backed securities (ABS), and corporate securities to simulate the universe of bonds in the market.

The Bloomberg Barclays US Aggregate Bond Float Adjusted Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

The CRSP US Total Market Index includes 4,000 constituents across mega, large, small and micro capitalizations, representing nearly 100% of the U.S. investable equity market, comprise the CRSP US Total Market Index.

The FTSE Global All Cap ex US Index is a free-float, [note 1] market-capitalization weighted index representing the performance of around 5350 large, mid and small cap companies in 46 developed and emerging markets worldwide, excluding the USA.

The Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index is composed of non-US dollar denominated investment-grade bonds. Employs hedging strategies to protect against uncertainty in exchange rates.

Exencial Wealth Advisors is an SEC registered investment adviser with its principal place of business in the State of Oklahoma. The information contained herein should not be construed as personalized investment advice. The information and data shown is of informational purposes and should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. Investing in the stock market involves gains and losses and may not be suitable for all investors. Exencial Wealth Advisors and its representatives are in compliance with the current registration and notice filing requirements imposed upon registered investment advisers by those states in which Exencial Wealth Advisors maintains clients. Exencial Wealth Advisors may only transact business in those states in which it is notice filed, or qualifies for an exemption or exclusion from notice filing. For information pertaining to the registration status of Exencial Wealth Advisors, please contact Exencial Wealth Advisors or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov). For additional information about Exencial Wealth Advisors, including fees and services, send for our disclosure statement as set forth on Form ADV from Exencial Wealth Advisors using the contact information herein. Please read the disclosure statement carefully before you invest or send money.”

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information provided in this book. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971