By Tim Courtney, Chief Investment Officer

While most of us exchange U.S. dollars regularly, we don’t often think about the value of our currency unless we are traveling outside the U.S. We read about other currencies, which have seen large declines or cryptocurrencies riding wild swings, but the U.S. dollar has been relatively stable. It has also been aided by the size and reach of the U.S. economy across the globe.

In the last 12 months, the dollar is down about 7% against a basket of other currencies, but this kind of movement is not unusual.1 Over the last 50 years, the dollar has moved higher and lower but, in total, has fallen about 25%2 against that basket as other economies and currencies have grown in importance. While it has only averaged a 0.5% decline per year over five decades, a potential long-term decline is one risk that dollar holders face.

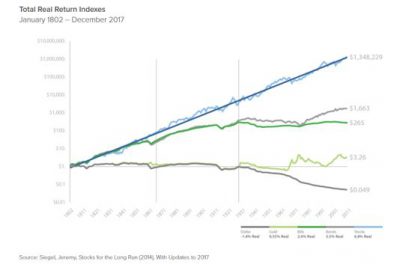

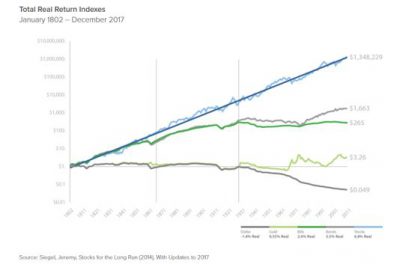

Another related risk is inflation as it also reduces the purchasing power of a dollar over time. As Jeremy Siegel shows in the chart below, the dollar now purchases less than 5% of what it could purchase 90 years ago.3

There are several ways we may hedge against the risk of dollar decline or inflation as investors. Some of these include:

- Real assets: These are tangible assets such as real estate, equipment, gold and other commodities. Gold has historically maintained its purchasing power and can be a good long-term hedge.

- International investments: Assets outside of the U.S. and denominated in other currencies offer another level of diversification to dollar decline. Having assets denominated in other currencies or companies that generate earnings in currencies other than the U.S. dollar can help provide some diversification against dollar decline.

- Stocks: Stocks have historically been a good hedge for inflation over time as growing earnings can at least partially offset the effects of inflation. We may also consider utilizing certain stocks such as material producers that better weather inflation.

Cryptocurrencies have recently been a popular way to hedge against dollar risk. However, because of their large price swings, they haven’t been shown to be a reliable store of value yet — one characteristic that is necessary for money.

As most of us spend and are paid in dollars, we want to see policymakers be good stewards of the dollar’s value. However, there are steps we can take to hedge that risk should the dollar weaken or inflation accelerate. If you have any questions, please contact your Exencial advisor.

Sources:

1. Bloomberg (1/25/21) — The dollar’s crash is only just beginning

2. Yahoo! Finance (06/11/21) – US Dollar/USDX Index

3. Jeremy Siegel (updated through 2017) — Stocks for the Long Run

4. US Inflation Calculator (data as of 6/7/21) — Historical inflation rates: 1914-2021

5. NBCNews.com (8/27/20) — Fed will let inflation rise and target jobs

6. Business Insider (5/8/21) – Nobel prize-winning economist Paul Krugman on inflation

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information provided in this book. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971.