From the end of 2008 to the conclusion of 2018, the U.S. markets significantly outperformed international developed markets. The S&P 5001 averaged a 13.1 percent return annualized during this period versus 6.8 percent2 for the MSCI EAFE Index3, which represents major international equity markets across developed countries in Europe, Australasia and the Far East.

Part of this outperformance was due to U.S. assets being more cheaply valued at the bottom of the downturn. Part of it was due to the U.S. economy having higher and more consistent growth than other developed markets over this period. However, this 10-year snapshot tells only a part of the story of the interaction between U.S. and international markets.

Over nearly five decades from 1970 through the end of 2018, the two indexes produced similar returns (9.1 percent a year for the EAFE2 vs. 10.2 percent for the S&P 5001). Taking the last 10 years out of the equation is even more illuminating, as the EAFE and S&P performed almost identically (9.7 percent per year2 vs. 9.5 percent1, respectively) between 1970 and 2008.

In a global marketplace, similar returns across developed markets are expected. When capital can flow freely between markets to where it will be best rewarded, long-term returns of similar-risk assets should be about the same. If a particular country is seen as riskier (as the U.S. was in late 2008) then prices there will fall to account for that extra risk. This can include geopolitical tensions, government mistakes and corruption, currency weakness, slower economic growth and other factors.

The U.S. has benefited from a more dynamic economy than most international markets, but it is important to understand that prices largely account for those advantages already. For example, compared to U.S. corporations, internationally domiciled companies are being discounted at a rate of 20-50 percent, 4 depending on the valuation metric. In some cases this discount belies growth prospects in international countries.

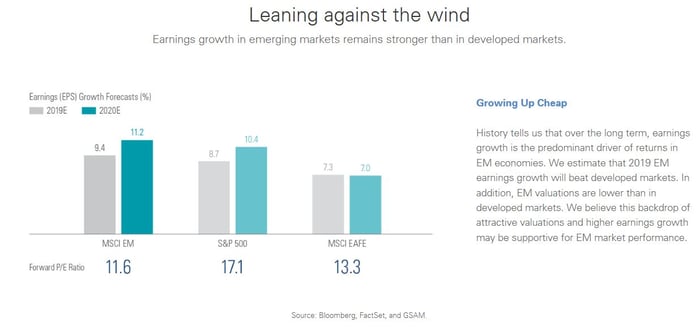

Looking at earnings growth, emerging market earnings are expected to grow at a slightly faster clip than the U.S. while international developed markets are expected to grow slightly more slowly. As noted in the chart below, Goldman Sachs has estimated that S&P growth this year will reach about 8 percent, with emerging markets at approximately 9 percent and developed markets at about 7 percent.

Additionally, as indicated in the above chart, the S&P currently trades at a forward price-to-earnings (P/E) ratio5 of 17.1, much more expensive than the 11.6 for emerging markets. International developed markets represented by the EAFE have a forward P/E ratio of 13.3. Looking at these prices we can see that more risk has been priced into international assets.

Historically, U.S. and foreign markets have had very similar returns over longer periods of time while they switch back and forth from outperformance to underperformance during shorter periods. Being diversified across markets keeps us from being too dependent on any one market, currency and economy when the situation in one area of the globe inevitably changes.

Sources:

1. Yahoo! Finance – S&P 500

2. DFA Returns

3. Investopedia – EAFE Index

4. Morningstar.com

5. Investopedia – Forward price-to-earnings – Forward P/E definition

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information provided in this book. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971