By Tim Courtney, Chief Investment Officer

Market expectations for 2021 came in high and have continued to climb on the heels of positive economic reports. Job growth has been encouraging1 and gross domestic product (GDP) growth estimates have nearly doubled over the last quarter.2

This optimism is being driven by an investor assumption that this economic kindling will be lit and produce a hot economy and great earnings for many quarters. While actual growth very well may meet these high expectations (we think growth will be quite high and early first-quarter earnings have been confirming this so far), there is, as always, a level of uncertainty and risk that we should acknowledge.

One major development over the last year has been the unprecedented interaction between the Federal Reserve and the markets. Throughout the pandemic, the Fed pumped a record amount of money into markets3 while the federal government simultaneously increased spending via stimulus checks and Paycheck Protection Program (PPP) loans.

While these actions provided support and confidence to investors as markets were see-sawing last year, it also has encouraged a higher level of risk taking. Much of the new cash has made its way into virtually every asset class and many investors have levered their positions by borrowing and investing additional cash, pushing borrowing/margin levels to all-time highs.

With cash being easier to come by, investing has in some cases given way to speculation. We’ve seen the effect this has had in the market manias of GameStop, AMC and others.4 During the shutdowns last year, investors were so frantic to buy shares of Zoom Video online conferencing that they mistakenly bought the wrong company, forcing the SEC to halt trading in the security.5

Many assets that have a shoot-for-the-moon promise have been favorite landing places for a lot of the free cash. We recently came across a brand new index with “Moonshot” in the name, which, in part, looks within a company’s regulatory filings for certain words such as “disruptive,” “innovative” or “groundbreaking” to determine if the stock will be included. While there is no doubt good companies use these words to describe their products or services, relying on words as part of an investment strategy sounds similar to companies adding “.com” (late 1990s) or “blockchain” (2018-2019) to their names during prior times of market speculation.

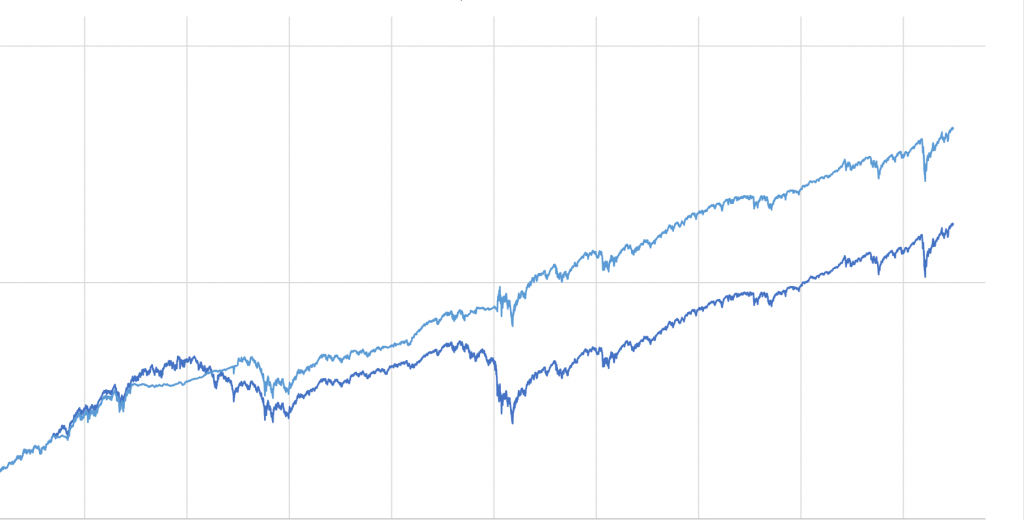

The liquidity made available by the Fed and the government is affecting asset prices to some degree and fueling speculation in certain areas of the market. We believe that remaining invested in a diversified portfolio of productive assets and companies is the proper course of action.

Investors should acknowledge though that even as the outlook for growth is quite positive, there is always uncertainty and risk and some of this risk is coming from increased leverage and speculation in markets. If you have any questions about current market conditions, please contact your Exencial advisor.

Sources

1. CNBC.com (4/2/21) – Jobs report blows past expectations as payrolls boom by 916,000 in March

2. The Wall Street Journal (4/11/21) – With economy poised for best growth since 1983, inflation lurks

3. CNBC.com (8/5/20) – The ballooning money supply may be the key to unlocking inflation in the U.S.

4. CNN Business (3/25/21) – GameStop, AMC and other meme stocks are meming again

5. Financial Times (3/26/20) – SEC steps in after investors buy up the wrong Zoom

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information provided in this book. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971.