October 2018

Weekly Commentary October 19, 2018

The Ebb and Flow of International Markets

By Tim Courtney, Chief Investment Officer

REMINDER: We have rescheduled our webinar discussing practical strategies for late-stage college funding for Thursday, November 1 at 12 p.m. CT. We hope you can still join us!

To register for the webinar, please click here.

After looking at the market right now, many are asking what the benefit is of investing in foreign assets. Even with the market’s abrupt dip last week1, the U.S. has outperformed international markets by about 6 percent per year over the last 10 years2, making it look like a much safer and more lucrative bet.

However, this is not the first time the U.S. market has outperformed international markets over a full decade. Historically when this has happened, international stocks have then usually outperformed U.S. stocks over the next decade. This back-and-forth has happened in about 82 percent of rolling 120-month observations2. One wins in one decade, the other tends to win the next decade.

From a capital standpoint, this makes sense. Capital usually flows from where there is a lot of it (i.e. where assets are expensive), to where there is not a lot (where assets are cheaper, but have higher expected returns). The more expensive assets become, the lower their future expected return.

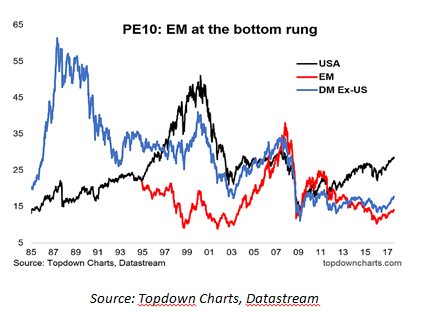

Through valuations, we can see a few key examples of alternations between the U.S. and foreign markets.

As seen in the chart above3, each quick peak was caused by high returns, but eventually valuations and returns reverted closer to mean in following years. For example, the 1980s saw a huge boom in Japan4. The country was buying up dynamic U.S. properties and seemed unstoppable, and money was flowing in from all corners of the world. This made Japan – then a huge component of developed international markets indexes – climb more steeply than the U.S. and become much more expensive.

By the late 1980s, the Japanese market had been saturated and valuations were so high they had nowhere to go but down. The U.S. was seen as the next model in efficiency, so investors started to pile in as tech quickly took over the markets, leading to the infamous dot-com bubble of the 2000s5.

In 2005 through 2010, the market was enamored by emerging market countries which were growing rapidly – particularly Brazil, Russia, India and China (BRIC)6. While the U.S. was seeing only about 2-3 percent growth at this time7, BRIC countries were seeing upward of 20 percent8 – a much more enticing offer for investors. Eventually, with capital flowing in these market valuations also got too high to sustain, even with the higher economic growth.

Today, capital has been flowing back to the U.S. market, and for good reason. The U.S. markets and economy have been more consistent, and buyers are willing to pay a premium for the steady keel of U.S. stocks2. U.S. markets are also more dynamic. In terms of innovation and invention, the U.S. is home to many companies leading the way9. This is especially true for the tech sector, which has been driving most U.S. growth over the past several years10.

However, the valuations already reflect much of this dynamism. While we certainly should stay invested in U.S. stocks because there is likely more growth to be had, it’s important to diversify so when news isn’t so favorable, we don’t find ourselves in the predicament Japan found itself during the 1980s.

Sources:

1 USA Today – Why did the stock market drop? Here are all the reasons for the Dow plunge

2 Exencial study based on DFA Returns 2.0, S&P 500 Total Return Index and MSCI EAFE ex Japan Gross total return in USD

3 Topdown Charts, Datastream

4 Business Insider – The true story of the 1980s, when everyone was convinced Japan would buy America

5 Investopedia – Dotcom Bubble

6 Investopedia – Brazil, Russia, India and China (BRIC)

7 Yahoo! Finance – S&P 500

8 MSCI BRIC Index (USD)

9 Business Insider – The 16 most innovative countries in the world

10 The Verge – The tech sector is leaving the rest of the US economy in its dust

PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RETURNS. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate. In addition, the links provided within are for convenience only and the provision of the links does not imply any sponsorship, endorsement, or approval of any of the content. We do not guarantee the content or its accuracy and completeness. The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not taken into account the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein and the author is not responsible for the consequences of any decisions or actions taken as a result of information provided in this book. There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Exencial Wealth Advisors, LLC (“EWA”) is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. EWA may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at 888-478-1971.

![]()